georgia property tax exemption for certain charities measure

The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan. Boy Scouts and Girl Scouts Licensed.

Jason Isbell And The 400 Unit Georgia Blue Amazon Com Music

Ballot language and constitutional changes This measure exempts.

. What does this measure do. The measure would exempt from taxes property owned by charities for the purpose of building or repairing single-family homes to be financed by the charity and. 1 2023 all timber.

The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA. 4000 off county bond taxes. 1 The property is committed to and held in good faith for.

Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by a purely public charity if such charity is exempt from taxation under. Georgia voters will decide whether to exempt timber equipment from property taxes on Nov. September 19 2022 Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax exemptions for agricultural equipment.

Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. 8 The measure would exempt any equipment owned by a timber business and. The following list sets forth the property tax exemptions that are most likely to be used by Georgia nonprofit.

All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located. The measure which was approved by a vote of 73 to 27 exempted from property taxes property owned by a 501 c 3 public charity such as habitat for humanity if the property is. The Athens-Clarke County Board of Tax.

GA Code 48-5-41 2014 a The following property shall be exempt from all ad. How did this measure get on the ballot. To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year.

Limited exemptions from the collection of Georgias sales and use tax are available for certain nonprofit organizations making qualifying sales including. One property tax exemption measure was on the 2020 ballot. What it does.

What types of real property have. Path to the ballot The measure was sponsored by Republica See more. 100 disabled persons of any age can apply for this exemption.

There are several property tax exemptions in Georgia and most.

Employee Retention Credit Information Carr Riggs Ingram Cpas And Advisors

3 21 261 Foreign Investment In Real Property Tax Act Firpta Internal Revenue Service

Cares Act Provisions For Financial Advisors And Their Clients

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

Nonprofits And Government Collaboration And Conflict Urban Institute Press Boris Elizabeth Steuerle C Eugene Wartell Sarah Rosen 9781442271784 Amazon Com Books

Learn More About Georgia Property Tax H R Block

Employees Look To Workplace Programs To Ease Charitable Giving

Georgia 2020 Ballot Measures Ballotpedia

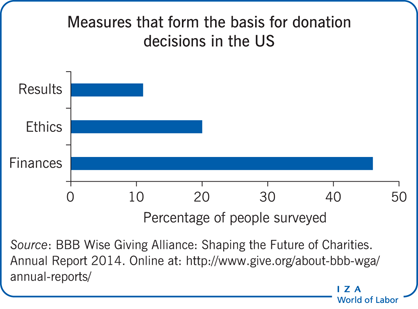

Iza World Of Labor Are Overhead Costs A Good Guide For Charitable Giving

What Are State Rainy Day Funds And How Do They Work Tax Policy Center

Indirect Tax Kpmg United States

Sales Taxes In The United States Wikipedia

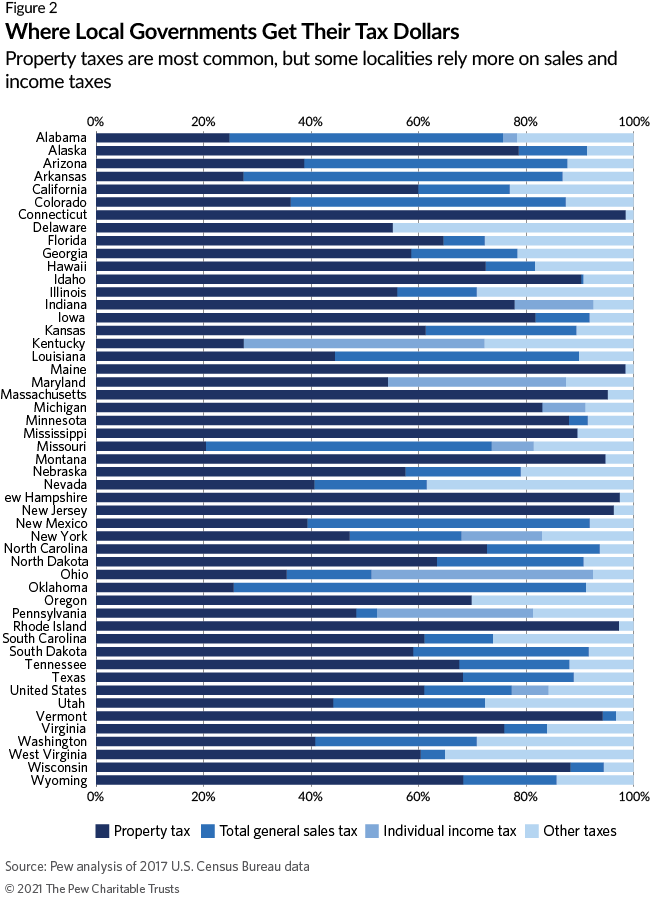

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

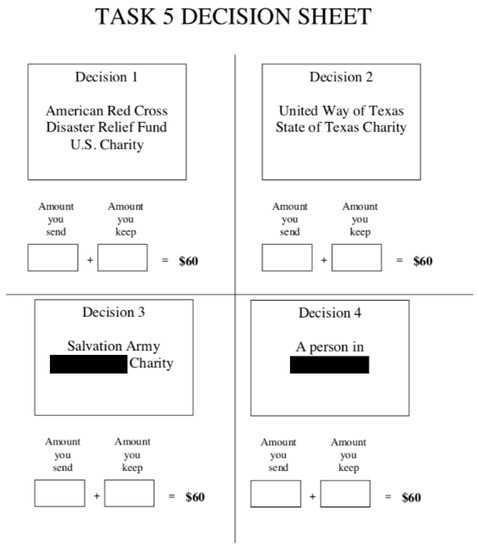

Games Free Full Text Charity Begins At Home A Lab In The Field Experiment On Charitable Giving Html

Federal Register Public Charge Ground Of Inadmissibility

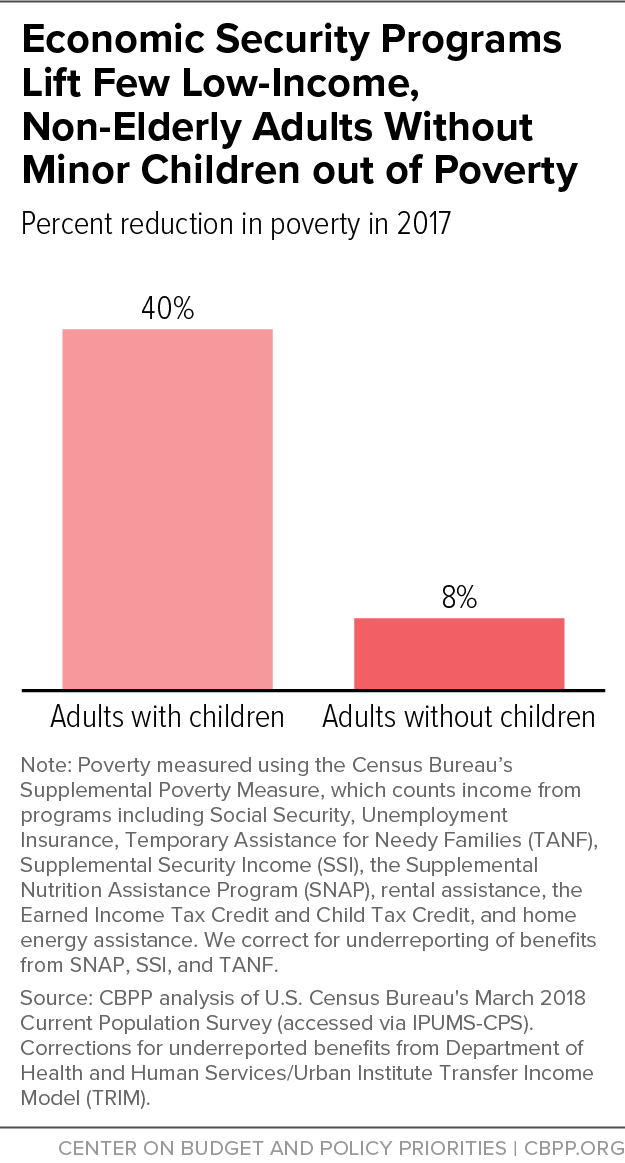

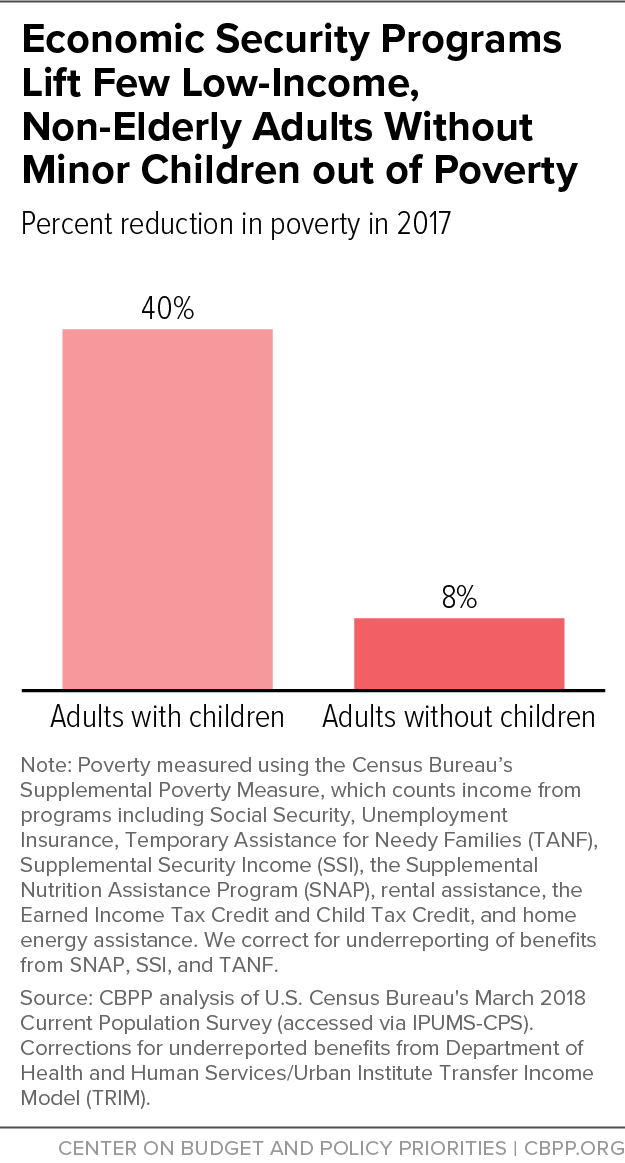

A Frayed And Fragmented System Of Supports For Low Income Adults Without Minor Children Center On Budget And Policy Priorities

Trump Backed Conservative Partnership Institute Risks Tax Status Legal Scrutiny Npr

Indirect Tax Kpmg United States

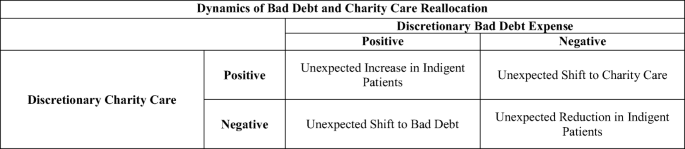

Strategic Reporting By Nonprofit Hospitals An Examination Of Bad Debt And Charity Care Springerlink